| |

BOARD SKILLS MATRIX |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | Experience, Expertise and Attributes | |  |  |  |  |  |  |  |  |  |  |  | | |

| | Payments / Financial Services and/ FinTech This experience is critical to oversight of PayPal’s business and strategy in these complex and dynamic industries. | |  |  | |  | |  |  | |  |  | • | | | | | | • | | • | | | | • | | • | | | | | | | | | | | | | | |

| | Technology and/ Innovation Because PayPal is a technology platform and digital payments company, we look for directors with a background in developing technology businesses, anticipating technological trends and driving innovation and product development. |  |  |  |  |  |  |  | |  |  | • | | • | | • | | • | | • | | • | | | | • | | • | | | | | | | | | | | | | | | | |

| | Global Business An understanding of diverse business environments, economic conditions, cultures and regulatory frameworks is relevant to PayPal as a global business operating in over 200 markets around the world. |  |  |  |  |  |  |  |  |  |  |  | • | | • | | • | | • | | • | | • | | • | | | | | | | | | | | | | | |

| | Senior Leadership Significant senior leadership and/or CEO experience, with a practical understanding of organizations, processes, strategic planning and risk management to assess, develop and implement our business strategy and operating plan. |  |  |  |  |  |  |  |  |  |  |  | • | | • | | • | | • | | • | | • | | • | | | | | | | | | | | | | | |

| | Business Development and Strategy This experience is relevant in helping PayPal to grow its business, expand its value proposition and assess whether potential targets and partners are a good strategic and culturecultural fit. |  |  |  |  |  |  |  |  |  |  |  | • | | • | | • | | • | | • | | • | | • | | | | | | | | | | | | | | |

| | Legal / Regulatory / Governmental Knowledge and experience with legal and regulatory issues, compliance obligations and governmental policies is relevant because we operate globally in a complex and rapidly evolving legal and regulatory environment. |  |  | |  |  |  |  |  |  |  |  | | | • | | • | | • | | • | | • | | • | | | | | | | | | | | | | | |

| | Cybersecurity / Information Security This experience is vital to protecting PayPal’s technology infrastructure and payments platform, maintaining the trust of our customers and keeping customer information secure. |  | • | |  |  | • | | • | | | | | | | | | | | | | | • | | | | | | | | | |  | | | | | | |

| | Finance / Accounting This experience is relevant to the oversight of PayPal’s capital structure, financing and investing activities, as well as our financial reporting and internal controls. |  |  |  |  |  |  |  |  |  |  |  | • | | • | | • | | • | | • | | • | | • | | | | | | | | | | | | | | |

| | Consumer / Sales / Marketing / Brand Management Experience in developing strategies to grow sales and market share, build brand awareness and overall preference among customers and enhance PayPal’s reputation is relevant to the growth of our business. |  | • | |  |  |  |  |  | |  |  | • | | • | | • | | • | | • | | | | • | | • | | | | | | | | | | | | | | | | | Human Capital

| | ESG An understanding of effective management and disclosure of environmental, social and/or governance (“ESG”) risks and opportunities is essential to ensure appropriate oversight of ESG at PayPal and create long-term value for our stakeholders. | | • | | • | | • | | • | | • | | • | | • | | • | | • | | | | • | | • | | | | | | | | | | | | | | |

| | Talent Management This experience is vital to ensuring that PayPal attracts, motivates, develops and retains qualified personnel, and fosters a corporate culture that encourages and promotes accountability, performance and diversity, inclusion, equity and belonging. |  | • | |  |  |  |  |  |  |  |  |  | | • | | • | | • | | • | | • | | • | | | | | | | | | | | | | | |

| | Other Public Company Board Service Service on a public company board provides insights about ensuring strong board and management accountability, protecting stockholder interests and observing appropriate governance practices. |  |  |  |  |  |  |  |  |  |  |  | • | | • | | • | | • | | • | | • | | • |

• 2021 Proxy Statement 11

| | |  •2023 Proxy Statement •2023 Proxy Statement | | 13 |

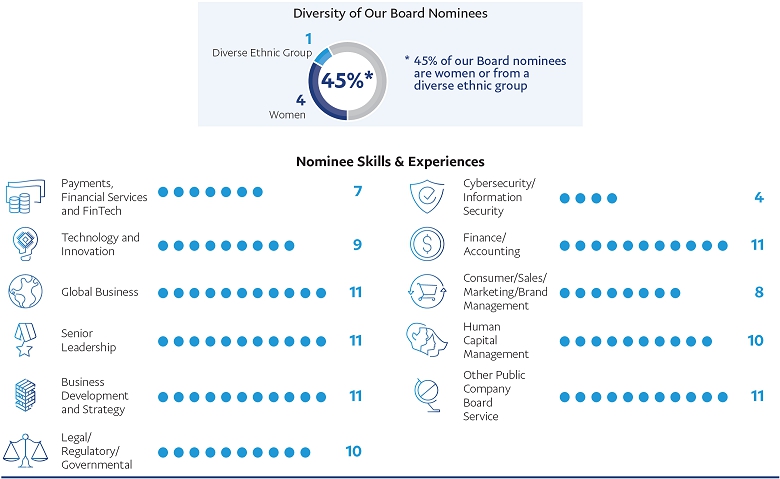

PROPOSAL 1: ELECTION OF DIRECTORS Director Nominees Focus on Board Refreshment and Diversity The Governance Committee regularly oversees and plans for director succession and Board refreshment. The Board values succession and refreshment over time as critical components to maintaining an appropriate balance of tenure, diversity, skills and experience needed to promote and support the Company’s long-term strategy. The Board believes that having a mix of experienced directors with a deep understanding of the Company and newer directors who bring fresh perspectives and innovative ideas provides significant benefits to the Company in driving and overseeing its strategy and operations and managing key risks. The Board does not believe in a specific limit for the overall length of time a director may serve. Directors who have served on the Board for an extended period can provide valuable insight into the operations and future of the Company based on their experience with, and understanding of, the Company’s history, policies and objectives. The Governance Committee values diversity as a factor in selecting nominees. When searching for new directors, the Governance Committee actively seeks out highly qualified women and individuals from underrepresented communities to include in the initial pool from which Board nominees are chosen. In keeping with this commitment to diversity and inclusion, our 12 director nominees include four people who identify as women, one person who identifies as African American or Black and one person who identifies as Hispanic or Latinx and White. Our active Board refreshment process has resulted in a strong mix of diversity and independence, which contributes to effective oversight of management and the Company. Since 2017, we have added five diverse directors to the Board, each of whom possesses a strong mix of skills, qualifications, backgrounds and experience, and has significantly contributed to and enhanced the overall effectiveness of the Board. Stockholder Recommendations and Nominations Stockholders who would like the Governance Committee to consider their recommendations for director nominees should submit their recommendations in writing by mail to the Governance Committee in care of our Corporate Secretary at PayPal Holdings, Inc., 2211 North First Street, San Jose, California 95131, stating the candidate’s name and qualifications for Board membership. Any such recommendation by a stockholder will receive the same consideration by the Governance Committee as other suggested nominees. In addition, our Restated Certificate of Incorporation and Bylaws provide proxy access rights that permit eligible stockholders to nominate candidates for election to the Board in the Company’s proxy statement. These proxy access rights permit a stockholder, or group of up to 20 stockholders, owning 3% or more of the Company’s outstanding common stock continuously for at least three years to nominate and include in the Company’s proxy materials director nominees constituting up to 20% of the Board, provided that the stockholder(s) and nominee(s) satisfy the requirements and procedures described in our Restated Certificate of Incorporation and Bylaws.  • 2021 Proxy Statement 12

| | | 14 | |  •2023 Proxy Statement •2023 Proxy Statement |

PROPOSAL 1: ELECTION OF DIRECTORS Director Biographies Director Biographies | | |

Age 62

Director since:

September 2017

INDEPENDENT

| | |

| | | | | | | | | | | | | | |  | | Board Committees:

•

Audit, Risk and Compliance

•

Governance

| | Other Public Company

Boards:

•

Avnet, Inc. (Chair)

•

United Parcel Service, Inc.

•

W.W. Grainger, Inc.

Former Public

Company Boards:

•

PPL Corporation (August 2014 to May 2019)

| | | | | | | | RODNEY C. ADKINS President of 3RAM Group LLC Experience, SkillsINDEPENDENT

|

| | Board Committees: • ARC • Governance | |

| Director since: September 2017 |

| |

| Age: 64 |

|

Key Qualifications and Experience:

| | Reasons for Nomination: Mr. Adkins brings extensive leadership experience driving innovation and Qualifications of Particular Relevance to PayPal: •

Extensive experiencebusiness solutions, as well as expertise in the technology industry, including emerging technologies, strategy, corporate finance and global business operations, innovation, product development and brand managementoperations.

|

Other Public Company Boards: Avnet, Inc. (Chair) United Parcel Service, Inc. W.W. Grainger, Inc. Former Public Company Boards: PPL Corporation (August 2014 to May 2019) Experience, Skills and Qualifications of Particular Relevance to PayPal: Extensive experience in the technology industry, including emerging technologies, strategy, global business operations, innovation, product development and brand management Significant experience in corporate finance, financial statements and accounting | • Significant experience in corporate finance, financial statements and accounting

| | In-depth expertise in corporate governance matters as a Boardboard member of other public companies•

|

Expertise in supply chain, procurement and global trade

Biography: President of 3RAM Group LLC, a privately held company specializing in capital investments, business consulting services and property management, since January 2015 Spent over 30 years at International Business Machines Corporation (“IBM”) in various development and management roles, including Senior Vice President of Corporate Strategy, from April 2013 to April 2014, Senior Vice President of Systems and Technology Group, from October 2009 to April 2013, Senior Vice President of Development & Manufacturing, from May 2007 to October 2009 and Vice President of Development of IBM Systems and Technology Group, from December 2003 to May 2007 | | | | | | | | | | | | | | |  | | Key Qualifications and Experience:

•

Technology and Innovation

•

Global Business

•

Senior Leadership

•

Business Development and Strategy

•

Regulatory and Governmental

•

Cybersecurity/Information Security

•

Finance

•

Consumer, Sales, Marketing and Brand Management

•

Human Capital Management

•

Other Public Company Board Service

| | | | Biography:

| | •

| President of 3RAM Group LLC, a privately held company specializing in capital investments, business consulting services and property management, since January 2015.

| •

Spent over 30 years at International Business Machines Corporation (IBM) in various development and management roles, including Senior Vice President of Corporate Strategy from April 2013 to April 2014, Senior Vice President of Systems and Technology Group from October 2009 to April 2013, Senior Vice President of Development & Manufacturing from May 2007 to October 2009, and Vice President of Development of IBM Systems and Technology Group from December 2003 to May 2007.

| | | |

Age 44

Director since:

July 2015

INDEPENDENT

Board Committees:

•

Compensation

•

Governance

Other Public Company Boards:

•

Pioneer Merger Corp.

•

Sandridge Energy, Inc.

•

Xerox Corporation

Former Public Company Boards:

•

Enzon Pharmaceuticals, Inc. (October 2013 to August 2020)

•

Herbalife Ltd. (April 2013 to January 2021)

•

Lyft, Inc. (May 2015 to March 2019)

| JONATHAN CHRISTODORO Partner at Patriot Global Management, L.P. Experience, Skills and Qualifications of Particular Relevance to PayPal:

•

Extensive financial, strategic planning and investment banking experience advising public companies, including at the board level

•

Significant experience in identifying and evaluating M&A and investment opportunities and portfolio companies across a range of industries, including technology

Key Qualifications and Experience:

•

Financial Services

•

Technology and Innovation

•

Global Business

•

Senior Leadership

•

Business Development and Strategy

•

Regulatory and Compliance

•

Finance

•

Other Public Company Board Service

LP

Biography:

•

Partner at Patriot Global Management, L.P., an investment management firm, since March 2019.

•

Managing Director of Icahn Capital LP, the entity through which Carl C. Icahn manages investment funds, from July 2012 to February 2017.

•

Served in various investment and research roles from, March 2007 to July 2012.

•

Began his career as an investment banking analyst at Morgan Stanley, where he focused on merger and acquisition transactions across a variety of industries.

•

Served in the United States Marine Corps.INDEPENDENT

|

• 2021 Proxy Statement 13

Age 60

| | Board Committees: • Compensation • Governance | |

| Director since: July 2015 | INDEPENDENT

Board Chair

| |

| Age: 46 |

|

Key Qualifications and Experience:

| | Reasons for Nomination: In addition to bringing a seasoned investor’s perspective to the Board, Committees: •

NonePayPal benefits from Mr. Christodoro’s substantial financial and M&A experience.

Other Public Company Boards:

|

Other Public Company Boards: None Former Public Company Boards: Xerox Corporation (June 2016 to May 2021) Herbalife Ltd. (April 2013 to January 2021) Lyft, Inc. (May 2015 to March 2019) Pioneer Merger Corp. (November 2020 to January 2023) Frontier Acquisition Corp. (February 2021 to March 2023) Sandridge Energy, Inc. (June 2018 to May 2021) Hologic, Inc. (December 2013 to March 2016) Cheniere Energy, Inc. (August 2015 to August 2017) Experience, Skills and Qualifications of Particular Relevance to PayPal: Extensive financial, strategic planning and investment banking experience advising public companies, including at the board level Significant experience in identifying and evaluating mergers and acquisitions and investment opportunities and portfolio companies across a range of industries, including technology Biography: Partner at Patriot Global Management, LP, an investment management firm, since March 2019 Managing Director of Icahn Capital LP, the entity through which Carl C. Icahn manages investment funds, from July 2012 to February 2017 Served in various investment and research roles from, March 2007 to July 2012 Began his career as an investment banking analyst at Morgan Stanley, where he focused on merger and acquisition transactions across a variety of industries Served in the United States Marine Corps | | |  •2023 Proxy Statement •2023 Proxy Statement | | Nike, Inc.15

|

PROPOSAL 1: ELECTION OF DIRECTORS Director Biographies | | | Former Public Company Boards:

•

ServiceNow, Inc. (April 2017 to June 2020)

| | |

| | | | | | | | | | | | |  | | •

| | eBay Inc. (January 2008 to July 2015)

| | | | | | JOHN J. DONAHOE President and Chief Executive Officer of Nike, Inc. Experience, Skills and Qualifications of Particular Relevance to PayPal:

•

Extensive industry experience and deep knowledge of PayPal’s operations through his former role as director, President and Chief Executive Officer of eBay Inc.

•

Expertise in commerce, technology, global strategy, operations and executive leadership

•

Extensive track record of creating value, driving innovation and scaling large technology companies

Key Qualifications and Experience:

•

Payments and FinTech

•

Technology and Innovation

•

Global Business

•

CEO Experience

•

Business Development and Strategy

•

Cybersecurity/Information Security

•

Finance

•

Consumer, Sales, Marketing and Brand Management

•

Human Capital Management

•

Other Public Company Board Service

Biography:

•

President and Chief Executive Officer of Nike, Inc., since January 2020.

•

President and Chief Executive Officer of ServiceNow, Inc., a cloud computing company, from April 2017 to December 2019.

•

President and Chief Executive Officer of eBay Inc. from March 2008 to July 2015, and director of eBay Inc., from January 2008 to July 2015.

•

President, eBay Marketplaces, from March 2005 to January 2008.

•

Worldwide Managing Director of Bain & Company, from January 2000 to February 2005.INDEPENDENT

| | | Board Committees: • None | |

| Director since: July 2015 |

| | Age: 62 |

Key Qualifications and Experience:

| |

Reasons for Nomination: Mr. Donahoe brings significant experience as a public company CEO leading global business, executive-level expertise in payments, FinTech and technology and a deep knowledge of the Company to PayPal’s Board and his role as Board Chair. Age 67

|

Other Public Company Boards: Nike, Inc. Former Public Company Boards: ServiceNow, Inc. (April 2017 to June 2020) eBay Inc. (January 2008 to July 2015) Experience, Skills and Qualifications of Particular Relevance to PayPal: Extensive industry experience and deep knowledge of PayPal’s operations through his former role as director, President and Chief Executive Officer of eBay Inc. Expertise in commerce, technology, global strategy, operations and executive leadership Extensive track record of creating value, driving innovation and scaling large technology companies Biography: President and Chief Executive Officer of Nike, Inc., since January 2020 President and Chief Executive Officer of ServiceNow, Inc., a cloud computing company, from April 2017 to December 2019 President and Chief Executive Officer of eBay Inc., from March 2008 to July 2015, and director of eBay Inc., from January 2008 to July 2015 President, eBay Marketplaces, from March 2005 to January 2008 Worldwide Managing Director of Bain & Company, from January 2000 to February 2005 | | | | | | | | | | | | |  | | Director since:

June 2015

| | INDEPENDENT

Board Committees:

•

Compensation (Chair)

•

Governance

Boards: Other Public Company

•

CVS Health Corporation

•

Dell Technologies, Inc.

Former Public

Company Boards:

•

Motorola Solutions, Inc. (May 2011 to May 2015)

| | | | | | DAVID W. DORMAN Former Non-Executive Board Chair of CVS Health Corporation Experience, SkillsINDEPENDENT

| | Board Committees: • Compensation (Chair) • Governance | |

| Director since: June 2015 |

| | Age: 69 |

Key Qualifications and Experience:

| | Reasons for Nomination: Mr. Dorman brings strong board- and Qualifications of Particular Relevance to PayPal: •

Expertiseexecutive-level experience leading global businesses in regulated industries, together with finance, M&A and investments, strategic planning, public companytalent management and executive compensation mattersexpertise, to PayPal’s Board and executive leadership

•his role as Compensation Committee Chair.

|

Other Public Company Boards: Dell Technologies, Inc. Former Public Company Boards: CVS Health Corporation (March 2006 to May 2022) Motorola Solutions, Inc. (May 2011 to May 2015) Experience, Skills and Qualifications of Particular Relevance to PayPal: Expertise in finance, mergers and acquisitions and investments, strategic planning, public company executive compensation matters and executive leadership | • | | In-depth experience leading global companies in regulated industries

|

Biography: Founding Partner of Centerview Capital Technology Fund, a private investment firm, since July 2013 Board Chair of InfoWorks, a portfolio company of Centerview, since January 2019 Key Qualifications and Experience:

| • Technology and Innovation

•

Global Business

•

CEO Experience

•

Business Development and Strategy

•

Regulatory and Compliance

•

Cybersecurity/Information Security

•

Finance and Accounting

•

Consumer, Sales, Marketing and Brand Management

•

Human Capital Management

•

Other Public Company Board Service

Biography:

•

Founding Partner of Centerview Capital Technology Fund, a private investment firm, since July 2013.

•

Board Chair of InfoWorks, a portfolio company of Centerview, since January 2019.

•

Lead Independent Director of

| | Served on the Board of Motorola Solutions, Inc. (formerly Motorola, Inc.), a leading providerDirectors of businessCVS Health Corporation from March 2006 until May 2022 and mission-critical communication products and services for enterprise and government customers,served as Non-Executive Board Chair from MayMarch 2011 until his retirement from that board in May 2015.2022 |

Lead Independent Director of the Board of Motorola Solutions, Inc. (formerly Motorola, Inc.), a leading provider of business and mission-critical communication products and services for enterprise and government customers, from May 2011 until his retirement from that board in May 2015 | • | | Non-Executive Board Chair of Motorola, Inc., from May 2008 to January 2011.2011 |

Senior Advisor and Managing Director to Warburg Pincus LLC, a global private equity firm, from October 2006 to May 2008 President and a director of AT&T Corporation, from November 2005 to January 2006 Board Chair and Chief Executive Officer of AT&T Corporation, from November 2002 to November 2005 President of AT&T Corporation, from 2000 to 2002, and the Chief Executive Officer of Concert Communications Services, a former global venture created by AT&T Corporation and British Telecommunications plc, from 1999 to 2000 Served as a Trustee for Georgia Tech Foundation, Inc. | | | 16 | |  •2023 Proxy Statement •2023 Proxy Statement |

PROPOSAL 1: ELECTION OF DIRECTORS Director Biographies | | | •

Senior Advisor and Managing Director to Warburg Pincus LLC, a global private equity firm, from October 2006 to May 2008.

•

President and a director of AT&T Corporation, from November 2005 until January 2006.

•

Board Chair and Chief Executive Officer of AT&T Corporation, from November 2002 until November 2005.

•

President of AT&T Corporation from 2000 to 2002 and the Chief Executive Officer of Concert Communications Services, a former global venture created by AT&T Corporation and British Telecommunications plc, from 1999 to 2000.

•

Served as a Trustee for Georgia Tech Foundation, Inc.

| | |

• 2021 Proxy Statement 14

Age 54

Director since:

January 2017

INDEPENDENT

Board Committees:

•

Audit, Risk and Compliance

Other Public Company

Boards:

•

Airbnb, Inc.

| BELINDA J. JOHNSON Former Chief Operating Officer of Airbnb, Inc. Experience, Skills and Qualifications of Particular Relevance to PayPal:INDEPENDENT

| | Board Committees: • ARC Significant strategic and operational

| |

| Director since: January 2017 |

| | Age: 56 |

Key Qualifications and Experience:

| | Reasons for Nomination: PayPal benefits from Ms. Johnson’s experience with a global, consumer-facing, technology company growing at scale •

Extensiveoverseeing legal, regulatory and government relations expertise as a practicing lawyeraffairs and business affairs leader gained over two decades advisingoperational matters for innovative and disruptive global technology companies

Key Qualifications and Experience:

•

Payments

•

Technology and Innovation

•

Global Business

•

Business Development and Strategy

•

Senior Leadership

•

Legal and Regulatory

•

Finance

•

Consumer, Sales, Marketing and Brand Management

•

Human Capital Management

•

Other Public Company Board Service

companies.

Biography:

•

Chief Operating Officer of Airbnb, Inc. from February 2018 to March 2020.

•

Chief Business Affairs and Legal Officer of Airbnb, Inc., from July 2015 to February 2018, having joined as General Counsel in December 2011.

•

|

Other Public Company Boards: Airbnb, Inc. Experience, Skills and Qualifications of Particular Relevance to PayPal: Extensive legal, regulatory and government relations expertise as a practicing lawyer and business affairs leader gained over two decades advising innovative and disruptive global technology companies Significant strategic and operational experience with a global, consumer-facing, technology company growing at scale Biography: Chief Operating Officer of Airbnb, Inc., from February 2018 to March 2020 Chief Business Affairs and Legal Officer of Airbnb, Inc., from July 2015 to February 2018, having joined as General Counsel in December 2011 Served in various positions at Yahoo! Inc., from August 1999 until her departure in August 2011, when she served as Senior Vice President and Deputy General Counsel | | | | | | | | |  | | | | | | | | | | ENRIQUE LORES President and Deputy General Counsel.CEO, HP Inc. •

General Counsel of Broadcast.com, Inc., an internet broadcasting company, from November 1996 to August 1999.INDEPENDENT

| | | Board Committees: • ARC | |

| Director since: June 2021 |

| | Age: 57 |

Key Qualifications and Experience:

| |

Reasons for Nomination: As President and CEO of HP Inc., Mr. Lores provides an enhanced global perspective based on his international business and leadership experience, as well as technology industry, product and operational expertise. |

Other Public Company Boards: HP Inc. Experience, Skills and Qualifications of Particular Relevance to PayPal: Deep experience at the highest levels of the information and technology industry with product and operational expertise Proven leader with extensive international business and leadership experience and global perspective Biography: President and Chief Executive Officer of HP Inc., an information technology company, since November 2019 President, Imaging and Printing Solutions, HP Inc., from November 2015 to October 2019 Spent over 30 years at The Hewlett-Packard Company in several positions of increasing responsibility ranging from Vice President, Imaging & Printing Group, EMEA to Senior Vice President & General Manager, Business Personal Systems and then Separation Leader, from 1989 to 2015 | | |  •2023 Proxy Statement •2023 Proxy Statement | | 17 |

PROPOSAL 1: ELECTION OF DIRECTORS Director Biographies | | | Age 69

Director since:

June 2015

INDEPENDENT

Board Committees:

•

Compensation

•

Governance (Chair)

Other Public Company Boards:

•

DTE Energy Company

| | |

| | | | | | | | |  | | | | | | | | | | GAIL J. MCGOVERN President and Chief Executive Officer of the American Red Cross Experience, Skills and Qualifications of Particular Relevance to PayPal:INDEPENDENT

| | •

Extensive executive experience in strategic planning, sales and marketing, customer relations and corporate financeBoard Committees:

• Compensation Strong expertise in regulatory matters and government relations garnered through leadership positions in regulated industries• Governance (Chair)

•

Brings a strong perspective from the academic and nonprofit worlds aligned with PayPal’s mission and vision

| | Key Qualifications and Experience:

•

Technology and Innovation

•

| Global BusinessDirector since:

•June 2015

CEO Experience

| •

Business Development and Strategy

•

Regulatory and Compliance

•

Finance

•

Consumer, Sales, Marketing and Brand Management

•

Human Capital Management

•

Other Public Company Board Service

| | Biography:Age:

•71

|

Key Qualifications and Experience:

| | Reasons for Nomination: Ms. McGovern brings a unique perspective to the Board and her role as Governance Chair based on her leadership experience in regulated industries and mission-driven organizations, including through her current role as President and Chief Executive OfficerCEO of the American Red Cross, a humanitarian organization, since June 2008.Cross. •

Faculty member at the Harvard Business School, from 2002 to 2008.

•

President of Fidelity Personal Investments, from 1998 to 2002.

•

Executive Vice President, Consumer Markets Division at AT&T Corporation, from 1997 to 1998.

•

Serves as a trustee of The Johns Hopkins University School of Medicine.

|

Other Public Company Boards:  • 2021 Proxy Statement 15

Experience, Skills and Qualifications of Particular Relevance to PayPal: Extensive executive experience in strategic planning, sales and marketing, customer relations and corporate finance Strong expertise in regulatory matters and government relations garnered through leadership positions in regulated industries Brings a strong perspective from the academic and nonprofit worlds aligned with PayPal’s mission and vision Biography: President and Chief Executive Officer of the American Red Cross, a humanitarian organization, since June 2008 Faculty member at the Harvard Business School, from 2002 to 2008 President of Fidelity Personal Investments, from 1998 to 2002 Executive Vice President, Consumer Markets Division at AT&T Corporation, from 1997 to 1998 Serves as a trustee of The Johns Hopkins University School of Medicine

Age 63

Director since:

January 2019

INDEPENDENT

Board Committees:

•

Audit, Risk and Compliance (Audit Committee Financial Expert)

Other Public Company

Boards:

•

Allogene Therapeutics, Inc.

| | | | | | | | | | DEBORAH M. MESSEMER Former Major Market Managing Partner at KPMG Experience, Skills and Qualifications of Particular Relevance to PayPal:INDEPENDENT

| | •

More than 30 years of experience in finance, strategy, market development, regulation, governance and operationsBoard Committees:

• ARC (Audit Committee

Financial Expert) Extensive expertise

| |

| Director since: January 2019 |

| | Age: 65 |

Key Qualifications and Experience:

| | Reasons for Nomination: Based on her extensive experience at KPMG for clients in financial reporting, due diligence, mergers and acquisitions, and internal controls over financial reporting as Audit Engagement Partner or Senior Relationship Partner for companies in a variety of industries including financial services and technology, • Ms. Messemer provides strong strategic and finance expertise, including with respect to financial reporting and internal controls.

Strong leadership and people management experience as Managing Partner of KPMG’s Bay Area and Northwest region, leading a team of over 3,000 employees

|

Other Public Company Boards: Allogene Therapeutics, Inc. TPG, Inc Experience, Skills and Qualifications of Particular Relevance to PayPal: More than 30 years of experience in finance, strategy, market development, regulation, governance and operations Strong leadership and people management experience as Managing Partner of KPMG’s Bay Area and Northwest region, leading a team of over 3,000 employees Extensive expertise in financial reporting, due diligence, mergers and acquisitions and internal controls over financial reporting as Audit Engagement Partner or Senior Relationship Partner for companies in a variety of industries, including financial services and technology Biography: Served for over 35 years at KPMG, one of the world’s leading professional services firms, first in the audit practice, then as Audit Engagement Partner or Global Senior Relationship Partner for clients in a variety of industries, including financial services and technology. She was Managing Partner of KPMG’s Bay Area and Northwest region, responsible for leading teams in 10 offices across all functions, from 2008 through her retirement in September 2018 Served on the Board of Directors of Carbon, Inc., a privately held company | | | Key Qualifications and Experience:18

| |  •2023 Proxy Statement •2023 Proxy Statement |

PROPOSAL 1: ELECTION OF DIRECTORS Director Biographies | | | Financial Services

•

Technology and Innovation

•

Global Business

•

Senior Leadership

•

Business Development and Strategy

•

Regulatory and Compliance

•

Finance and Accounting

•

Consumer Sales, Marketing and Brand Management

•

Human Capital Management

•

Other Public Company Board Service

Biography:

•

Served for over 35 years at KPMG, one

| | |

| | | | | | | | | | |  | | | | | | | | | | | | DAVID M. MOFFETT Former Chief Executive Officer of the world’s leading professional services firms, first in the audit practice, then as Audit Engagement Partner or Global Senior Relationship Partner for clients in a variety of industries, including financial services and technology. She was Managing Partner of KPMG’s Bay Area and Northwest region, responsible for leading teams in 10 offices across all functions, from 2008 through her retirement in September 2018.Federal

Home Loan Mortgage Corp. •INDEPENDENT

|

Serves on the Board of Directors of Carbon, Inc.

| | | |

Age 69

Director since:

June 2015

INDEPENDENT

Board Committees: • Audit, Risk and Compliance ARC (Chair) (Audit Committee Financial Expert)

| | Other Public Company

Boards:

•

CSX Corporation

•

Genworth Financial, Inc.

| Former Public

Company Boards:Director since:

•June 2015

Freddie Mac (December 2008 to March 2009)

•

eBay Inc. (July 2007 to July 2015)

| DAVID M. MOFFETT

Former Chief Executive Officer of Federal Home Loan Mortgage Corp.

Experience, Skills and Qualifications of Particular Relevance to PayPal:

•

More than 30 years of strategic finance, mergers and acquisitions, risk management and operational experience in banking and payment processing

•

Strong leadership experience and extensive global financial management and regulatory expertise as a former Chief Executive Officer and Chief Financial Officer of financial services companies

Key Qualifications and Experience:

•

Payments

•

Global Business

•

CEO Experience

•

Business Development and Strategy

•

Governmental, Regulatory and Compliance

•

Finance and Accounting

•

Human Capital Management

•

Other Public Company Board Service

| |

Biography:

•

| Age:

71 Lead Independent Director of

|

|

Key Qualifications and Experience:

| | Reasons for Nomination: PayPal benefits from July 2015 through December 2018. •

Chief Executive Officer of Federal Home Loan Mortgage Corp. (“Freddie Mac”), from September 2008 until his retirementMr. Moffett’s significant leadership experience in March 2009, and director of Freddie Mac from December 2008 to March 2009.

•

Chief Financial Officer of Star Banc Corporation, a bank holding company, starting in 1993. During his tenure, played an integral role in the acquisition of Firstar Corporation in 1998 and later U.S. Bancorp in 2001. Mr. Moffett remained Chief Financial Officer of U.S. Bancorp until 2007.

•

Trustee for Columbia Atlantic Mutual Funds and University of Oklahoma Foundation; consultant to various financial services companies.and his strong financial reporting, audit, risk and compliance, capital allocation and M&A expertise is directly relevant to his role as ARC Committee Chair.

|

Other Public Company Boards:  • 2021 Proxy Statement 16

Former Public Company Boards: Genworth Financial, Inc. (December 2012 to May 2021) Freddie Mac (December 2008 to March 2009) eBay Inc. (July 2007 to July 2015) Experience, Skills and Qualifications of Particular Relevance to PayPal: Strong leadership experience and extensive global financial management and regulatory expertise as a former Chief Executive Officer and Chief Financial Officer of financial services companies More than 30 years of strategic finance, mergers and acquisitions, risk management and operational experience in banking and payment processing Biography: Lead Independent Director of PayPal, from July 2015 to December 2018 Chief Executive Officer of Federal Home Loan Mortgage Corp. (“Freddie Mac”), from September 2008 until his retirement in March 2009, and director of Freddie Mac, from December 2008 to March 2009 Chief Financial Officer of Star Banc Corporation, a bank holding company, starting in 1993. During his tenure, he played an integral role in the acquisition of Firstar Corporation in 1998 and later U.S. Bancorp in 2001. Mr. Moffett remained Chief Financial Officer of U.S. Bancorp until 2007 Serves as a Trustee for Columbia Threadneedle Mutual Funds and University of Oklahoma Foundation and as a consultant to various financial services companies

Age 59

Director since:

June 2017

INDEPENDENT

Board Committees:

•

Audit, Risk and Compliance

Other Public Company

Boards:

•

None

Former Public

Company Boards:

•

HSN, Inc. (December 2012 to December 2017)

| | | | | | | | | | | | ANN M. SARNOFF Former Board Chair and Chief Executive Officer of WarnerMedia Studios & Networks Group INDEPENDENT | Experience, Skills

| | Board Committees: • ARC | |

| Director since: June 2017 |

| |

| Age:

61 |

|

Key Qualifications and Experience:

| | Reasons for Nomination: Ms. Sarnoff brings substantial experience creating innovative partnerships and Qualifications of Particular Relevance to PayPal: •

More than 30 years of diversified business and media experience from a variety of executive leadership roles

•

Expertisetechnology-focused solutions across platforms, as well as expertise in driving consumer engagement with brands and developing innovative partnerships

•

Extensive technology experience across media and platforms

Key Qualifications and Experience:

•

Technology and Innovation

•

Global Business

•

CEO Experience

•

Business Development and Strategy

•

Regulatory

•

Finance

•

Consumer, Sales, Marketing and Brand Management

•

Human Capital Management

•

Other Public Company Board Service

global business development.

|

Other Public Company Boards: None Former Public Company Boards: HSN, Inc. (December 2012 to December 2017) Experience, Skills and Qualifications of Particular Relevance to PayPal: More than 30 years of diversified business and media experience through a variety of executive leadership roles Expertise in driving consumer engagement with brands and developing innovative partnerships Extensive technology experience across media and platforms Biography: Board Chair and Chief Executive Officer of WarnerMedia Studios & Networks Group, a global leader in entertainment and consumer products, from August 2020 to April 2022 Board Chair and Chief Executive Officer of Warner Bros. Entertainment, from August 2019 to August 2020 President of BBC Studios Americas, from August 2015 to August 2019 Chief Operating Officer of BBC Worldwide North America, from 2010 to July 2015 Board Chair of BritBox, a joint venture subscription streaming service launched in partnership with ITV in March 2017 Serves as vice chair of the boards of McDonough School of Business at Georgetown and The Shed, serves as a member of the boards of directors of Realm Media and WTA Ventures | | |  •2023 Proxy Statement •2023 Proxy Statement | | 19 |

PROPOSAL 1: ELECTION OF DIRECTORS Director Biographies | | | •

Board Chair and Chief Executive Officer of WarnerMedia Studios & Networks Group, a global leader in entertainment and consumer products, since August 2020.

•

Board Chair and Chief Executive Officer of Warner Bros. Entertainment, from August 2019 to August 2020.

•

President of BBC Studios Americas, from August 2015 to August 2019.

•

Chief Operating Officer of BBC Worldwide North America, from 2010 to July 2015.

•

Board Chair of BritBox, a joint venture subscription streaming service launched in partnership with ITV in March of 2017.

•

Member of the board of directors of Georgetown University and the vice chair of the McDonough School of Business at Georgetown.

| | |

| | | | | | | | | | |  | | | | | | | | | | | | | |

Age 63

Director since:

July 2015

Board Committees:

•

None

Other Public Company Boards:

•

Verizon Communications Inc.

Former Public Company Boards:

•

Flex Ltd. (June 2009 to August 2018)

•

NortonLifeLock (formerly known as Symantec Corporation), Board Chair (January 2013 to December 2019)

| DANIEL H. SCHULMAN President and Chief Executive Officer of PayPal |

| | Experience, Skills and Qualifications of Particular Relevance to PayPal:Board Committees:

| |

| Director since: July 2015 |

| |

| Age:

65 |

|

Key Qualifications and Experience:

| | Reasons for Nomination: As PayPal’s CEO, Mr. Schulman brings deep leadership experience in payments, financial services, mobile technology, innovation, regulatory and cybersecurity, matters •

Leadership experience and vision in growing large, complex businesses

•

Experience transforming financial services while driving cultural change and fostering a values-based environment that champions diversity, inclusion, equity and belonging

Key Qualifications and Experience:

•

Payments, Financial Services and FinTech

•

Technology and Innovation

•

Global Business

•

CEO Experience

•

Business Development and Strategy

•

Legal, Regulatory and Governmental

•

Cybersecurity/Information Security

•

Finance and Accounting

•

Consumer, Sales, Marketing and Brand Management

•

Human Capital Management

•

Other Public Company Board Service

as well as in-depth knowledge of the Company.

Biography:

•

President and Chief Executive Officer of PayPal since July 2015; served as the President and CEO-Designee of PayPal from September 2014 until July 2015.

•

Group President, Enterprise Group of American Express Company, from August 2010 to August 2014.

•

President, Prepaid Group of Sprint Nextel Corporation, from November 2009 until August 2010, when Sprint Nextel acquired Virgin Mobile, USA.

|

Other Public Company Boards:  • 2021 Proxy Statement 17

Verizon Communications Inc. Former Public Company Boards: NortonLifeLock (formerly known as Symantec Corporation), Board Chair (January 2013 to December 2019) Flex Ltd. (June 2009 to August 2018) Experience, Skills and Qualifications of Particular Relevance to PayPal: Deep expertise in payments, financial services, mobile technology, innovation, regulatory and cybersecurity matters Leadership experience and vision in growing large, complex businesses Experience transforming financial services while driving cultural change and fostering a values-based environment that champions DIE&B Biography: President and Chief Executive Officer of PayPal, since July 2015; served as the President and CEO-Designee of PayPal, from September 2014 to July 2015 Group President, Enterprise Group of American Express Company, from August 2010 to August 2014 President, Prepaid Group of Sprint Nextel Corporation, from November 2009 to August 2010, when Sprint Nextel acquired Virgin Mobile, USA

Age 57

Director since:

July 2015

INDEPENDENT

Board Committees:

•

Audit, Risk and Compliance

Other Public Company Boards:

•

Intel Corporation

| | | | | | | | | | | | FRANK D. YEARY Managing Member at Darwin Capital Advisors, LLC INDEPENDENT | Experience, Skills and Qualifications of Particular Relevance to PayPal:

| | Board Committees: • ARC Extensive career in investment banking and finance with

| |

| Director since: July 2015 |

| |

| Age:

59 |

|

Key Qualifications and Experience:

| | Reasons for Nomination: Mr. Yeary brings deep financial strategyacumen and global M&A expertise including expertise in financial reporting and experience in assessingto the efficacy of mergers and acquisitions with international companies on a global scale, and experience attracting and retaining strong senior leaders •

RoleBoard, as a Vice Chancellor andwell as Chief Administration Officer of a large public research university provides strategic and financial expertise

•

Extensive experience inrobust corporate governance and stockholder engagement, including as a co-founder of CamberView Partners, a financial advisory firm providing independent, investor-led advice to public companies and their boards

Key Qualifications and Experience:

•

Financial Services

•

Global Business

•

Senior Leadership

•

Business Development and Strategy

•

Governmental, Regulatory and Compliance

•

Finance and Accounting

•

Human Capital Management

•

Other Public Company Board Service

Biography:

•

Managing Member at Darwin Capital Advisors, LLC, a private investment firm, since October 2018expertise and a Member since 2012.strong understanding of investor perspectives.

•

Executive Chair of CamberView Partners, LLC, a corporate advisory firm, from 2012 until 2018.

•

Vice Chancellor of the University of California, Berkeley, a public university, from 2008 to 2012, where he led and implemented changes to the university’s financial and operating strategy.

•

Spent 25 years in the finance industry, most recently as Managing Director, Global Head of Mergers and Acquisitions and as a member of the Management Committee at Citigroup Investment Banking.

|

Other Public Company Boards: Intel Corporation (Chair) Mobileye Global, Inc. Experience, Skills and Qualifications of Particular Relevance to PayPal: Extensive career in investment banking and finance with financial strategy and global mergers and acquisitions expertise, including expertise in financial reporting, experience in assessing the efficacy of mergers and acquisitions with international companies on a global scale and experience attracting and retaining strong senior leaders Role as a Vice Chancellor and as Chief Administration Officer of a large public research university provides strategic and financial expertise Extensive experience in corporate governance and stockholder engagement, including as a co-founder of CamberView Partners, a financial advisory firm providing independent, investor-led advice to public companies and their boards Biography: Managing Member at Darwin Capital Advisors, LLC, a private investment firm, since October 2018 and a Member since 2012 Executive Chair of CamberView Partners, LLC, a corporate advisory firm, from 2012 to 2018 Vice Chancellor of the University of California, Berkeley, a public university, from 2008 to 2012, where he led and implemented changes to the university’s financial and operating strategy Spent 25 years in the finance industry, most recently as Managing Director, Global Head of Mergers and Acquisitions and as a member of the Management Committee at Citigroup Investment Banking The Board and the Governance Committee believe that the combination of our director nominees’ qualifications, skills and experience will contribute to an effective Board and that, individually and collectively, the director nominees have the necessary qualifications to provide effective oversight of the business and quality advice and counsel to management.  | | | | |  | | THE BOARD RECOMMENDS A VOTE FOR EACH OF THE DIRECTOR NOMINEES. |

• 2021 Proxy Statement 18

| | | 20 | |  •2023 Proxy Statement •2023 Proxy Statement |

CORPORATE GOVERNANCE Corporate Governance Corporate governance at PayPal is designed to promote the long-term interests of our stockholders, strengthen Board and management accountability, oversee risk assessment and management strategies, foster responsible decision-making and engender public trust. We believe that strong corporate governance practices that provide meaningful rights to our stockholders and ensure Board and management accountability are essential to our long-term success. Board Leadership OurThe Board’s leadership structure is designed to promote Board elects oureffectiveness and to appropriately allocate authority and responsibility between the Board and management. The Board believes that separating the Chair and our CEO positions continues to be the appropriate leadership structure for the Company at this time, as it provides the Company and has determined that these two roles should be held by separate individuals to enhance the Board’sBoard with strong leadership and independent oversight of management and to allowallows the CEO to focus primarily on the management responsibilities. Our currentand operation of our business. Factors that the Board considers in reviewing its leadership structure provides effective and making this determination include, but are not limited to, the current composition of the Board, the policies and practices in place to provide independent Board oversight of management, the Company’s circumstances and the Company.views of our stockholders and other stakeholders. Changes in the Board’s leadership structure will be reflected on our website shortly after becoming effective and disclosed in compliance with applicable regulatory requirements.

Independent Chair  | | | | |  | | | | JOHN J. DONAHOE |

| | | Mr. Donahoe has served as the Board Chair since PayPal became an independent public company in July 2015. Since December 2018, theThe Board has concluded that Mr. Donahoe is an independent director under the listing standards of the Nasdaq Global Select Market (“Nasdaq”) and our Corporatethe Governance Guidelines.

Mr. Donahoe possesses extensive industry experience and deep knowledge of PayPal’s operations, serves as a trusted advisor to management and effectively leads a dynamic and collaborative Board. |

Robust Independent Chair Responsibilities | • | Calls meetings of the Board and independent directors | | • | Sets the agenda for Board meetings in consultation with other directors and the CEO | | • | Provides management with input as to the quality, quantity and timeliness of the flow of information that is necessary for the independent directors to effectively and responsibly perform their duties | | • | Chairs executive sessions of the independent directors | | • | Acts as a liaison between the independent directors and the CEO on sensitive issues | | • | Leads the Board in theBoard’s annual CEO performance evaluation | | • | Leads the Board in itsBoard’s review of the results of the annual self-evaluation process, including acting on director feedback as needed• Engages and consults with major stockholders and other constituencies, where appropriate |

| | |  •2023 Proxy Statement •2023 Proxy Statement | | 21 |

CORPORATE GOVERNANCE Director Independence Director Independence Under the Nasdaq listing standards and our Corporate Governance Guidelines, the Board must consist of a majority of independent directors. Annually, each director completes a questionnaire designed to assist the Board in determining whether the director is independent, and whether members of the Audit, Risk and Compliance (“ARC”)ARC Committee and the Compensation Committee satisfy additional Securities and Exchange Commission (“SEC”) and Nasdaq independence requirements. The Board has adopted guidelines setting forth certain categories of transactions, relationships and arrangements that it has deemed immaterial for purposes of determining independence. Based on its most recentthe review and recommendation by the Governance Committee, the Board analyzed the independence of each director and has determined that every director except Mr. Schulman, our CEO, is independentMses. Johnson, McGovern, Messemer and Sarnoff and Messrs. Adkins, Christodoro, Donahoe, Dorman, Lores, Moffett and Yeary meet the standards of independence under the Nasdaq listing standards and our Corporatethe Governance Guidelines, and has noincluding that each director is free of any relationship that would interfere with their individual exercise of independent judgment. Our Corporate Governance Guidelines prohibit Company directors from serving on the board of directorsas a director or as an officer of another company that may cause a significant conflict of interest. Our Corporate Governance Guidelines also provide that any director who has previously been determined to be independent must inform the Board Chair and our Corporate Secretary of any significant change in personal circumstances that may cause their status as an independent director to change, including a change in principal occupation, change in professional roles and responsibilities, status as a member of the board of another public company or retirement.retirement, in each case including changes that may affect the continued appropriateness of Board or committee membership. In such situations, the Governance Committee makes a recommendation to the Board on the continued appropriateness of such director’s Board or committee membership(s).  • 2021 Proxy Statement 19

Board Committees The Board has three principal standing committees: the ARC Committee, the Compensation Committee and the Governance Committee. Each committee has a written charter that addresses, among other matters, the committee’s purposes and policy, composition and organization, duties and responsibilities and meetings. The committee charters are available in the governance section of our Investor Relations website at https://investor.pypl.com/governance/governance-overview/default.aspxgovernance. Each charter permits the applicable committee, in its discretion, to delegate all or a portion of its duties and responsibilities to a subcommittee or any member of the committee. Subject to applicable law, listing standards and the terms of its charter, the Compensation Committee also may delegate duties and responsibilities to any officer(s) of the Company. | | | 22 | |  •2023 Proxy Statement •2023 Proxy Statement |

CORPORATE GOVERNANCE Board Committees Below is a description of each principal committee of the Board. ARC Committee

| | | | | | | | | | |  | | | | | | | | | | | | | | | | ARC Committee | | | | | | | | | DAVID M. MOFFETT Chair | | | | Committee Meetings in 2022:12 |

Other Members: Other Members:

Rodney C. Adkins

Belinda J. Johnson

Enrique Lores

Deborah M. Messemer

Ann M. Sarnoff

Frank D. Yeary | Committee

Meetings in 2020: 9

| CHAIR: DAVID M. MOFFETT

| | Primary Responsibilities Provide assistance and guidance to the Board in fulfilling its oversight responsibilities with respect to: • PayPal’s corporate accounting and financial reporting practices and the audit of PayPal’s financial statements; •

• The independent auditors, including their qualifications and independence; •

• The performance of PayPal’s internal audit function and independent auditor; •

• The quality and integrity of PayPal’s financial statements and reports; •

• PayPal’s overall risk framework and risk appetite framework, including risks associated with cybersecurity, information security and privacy; and •

• PayPal’s compliance with legal and regulatory obligations. The ARC Committee is also responsible for reviewing and approving all audit engagement fees and terms, as well as all non-audit engagements, with the independent auditor and producing the Audit Committee Report for inclusion in our proxy statement. Independence The Board has determined that each member of the ARC Committee meets the independence requirements of Nasdaq and the SEC and otherwise satisfies the requirements for audit committee service imposed by the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has also determined that each member of the ARC Committee is financially literate, and that Mr. Moffett and Ms. Messemer both satisfy the requirements for an “audit committee financial expert” set forth in the SEC rules. | | | | | | | | Recent Activities & Focus Areas • Evaluated the quality and integrity of the Company’s financial statements and reports, the effectiveness of internal accounting and financial reporting controls and the results of the annual audit. • Engaged regularly with our Chief Risk and Compliance Officer on key and emerging risks facing the Company, including cybersecurity and geopolitical and macroeconomic instability. • Invited internal and external experts to discuss evolving risks and trends pertinent to the Company, including cybersecurity and government regulation. |

• 2021 Proxy Statement 20

| | |  •2023 Proxy Statement •2023 Proxy Statement | | 23 |

Compensation Committee

CORPORATE GOVERNANCE Board Committees | | | | | | | | | | |  | | | | | | | | | | | | | | | |

Compensation Committee | | | | | | | | | | DAVID W. DORMAN Chair | | | | Committee Meetings in 2022: 7 | Other Members: Other Members:

Jonathan Christodoro

Gail J. McGovern Committee

Meetings in 2020: 5

| CHAIR: DAVID W. DORMAN

| | Primary Responsibilities • Review and approve the overall strategy for employee compensation and all compensation programs applicable to non-employee directorsexecutive officers and executive officers;non-employee directors; • Annually review and approve corporate goals and objectives relevant to the compensation of the CEO and evaluate the CEO’s performance; •

• Review, determine and approve the compensation for the CEO and our other executive officers; •

• Review and discuss the Compensation Discussion and Analysis contained in our proxy statement and prepare the Compensation Committee Report for inclusion in our proxy statement and our Annual Report on Form 10-K; • Oversee and monitor the Company’s strategies and responsibilities related to human capital management, including diversity, inclusion, equity and belonging,DIE&B, pay equity efforts and corporate culture; •

• Review and approve, and oversee and monitor compliance with, policies with respect to the recovery or “clawback” of compensation; • Review and consider the results of any advisory stockholder votes on named executive officer compensation; and •

• Oversee and monitor compliance with the Company’s stock ownership guidelines applicable to non-employee directors and executive officers. Independence The Board has determined that each member of the Compensation Committee meets the independence requirements of Nasdaq and the SEC. Additionally, the Compensation Committee assesses on an annual basis the independence of its compensation consultant and other compensation advisers. Additional disclosureinformation regarding the role of the Compensation Committee in compensation matters, including the role of consultants, appearsis provided in the Compensation Discussion and Analysis section of this proxy statement. Compensation Committee Interlocks and Insider Participation None of the members of the Compensation Committee is or has been an employee of PayPal. None of our executive officers served on the board of directors or compensation committee of another entity that has an executive officer serving on the Board or the Compensation Committee. | | | | | | | | Recent Activities & Focus Areas • Oversaw the Company’s launch of the Leadership Principles and enhancements to our talent management strategies. • Advised management on compensation considerations with respect to executive leadership transitions. • Supported compensation programs focused on promoting employee wellness and retention strategies. |

| | | 24 | |  •2023 Proxy Statement •2023 Proxy Statement |

Governance Committee

CORPORATE GOVERNANCE Board Committees | | | | | | | | | | |  | | | | | | | | | | | | | | | |

Governance Committee | | | | | | | | | | GAIL J. MCGOVERN Chair | | | | Committee Meetings in 2022: 4 | Other Members: Other Members:

Rodney C. Adkins

Jonathan Christodoro

David W. Dorman Committee Meetings in 2020: 4

| CHAIR: GAIL J. MCGOVERN

| | Primary Responsibilities • Make recommendations to the Board as to the appropriate size of the Board or any Board committee; •

• Identify individuals believed to be qualified to become Board members; •

• Make recommendations to the Board on potential Board and Board committee members, whether as a result of any vacancy or as part of the annual election cycle, taking into consideration the criteria set forth in the “Board Member Criteria” sectionand “Guiding Principles for Board Development and Succession” sections of the Corporate Governance Guidelines; •

• Review and, if necessary, update, our Corporate Governance Guidelines at least annually; •

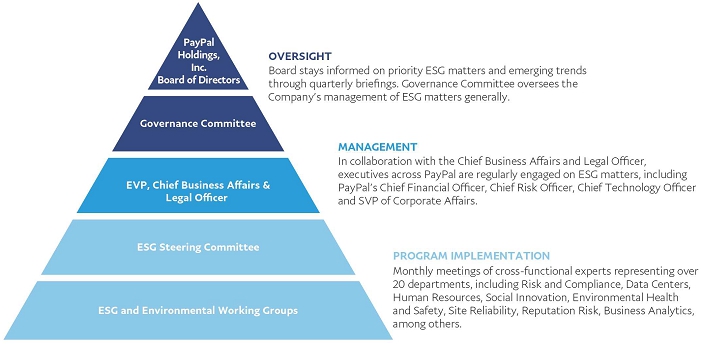

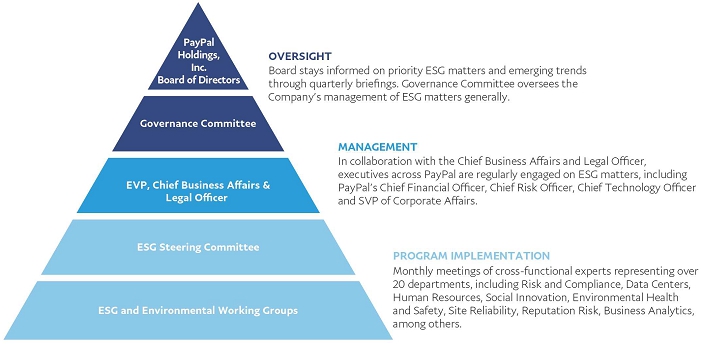

• Establish procedures to exercise oversight of the evaluation of the Board and management;Board; • Exercise general oversight of the Company’s management of topics related to ESG matters, including overall ESG strategy, risk and opportunities, stakeholder engagement and reporting and programs, and initiatives in social innovation and environmental sustainability;sustainability and the Company’s Global Impact Report; and •

• Review and discuss with management, at least annually, PayPal’s overall approach to, and guidelines and policies for, political contributionsactivities and expenditures to ensure consistency with PayPal’s business objectives and lobbying activities.public policy priorities. Independence The Board has determined that each member of the Governance Committee meets the independence requirements of Nasdaq. | | | | | | | | Recent Activities & Focus Areas • Stayed informed on feedback from investor outreach program and corporate governance developments. • Reviewed the Company’s medium-term ESG strategy and annual political expenditures. • Assessed the qualifications and independence of director nominees. |

• 2021 Proxy Statement 21

| | |  •2023 Proxy Statement •2023 Proxy Statement | | 25 |

CORPORATE GOVERNANCE Board Oversight Board Oversight The Board is responsible for providing advice and oversight of PayPal’s strategic and operational direction and overseeing its seniorexecutive management to support the long-term interests of the Company and its stockholders.

Strategic Oversight One of the Board’s primary responsibilities is overseeing management’s establishment and execution of the Company’s strategy. The Board works with management to respond to the dynamic, competitive environment in which PayPal operates. At least quarterly, the CEO and senior executivesexecutive management provide detailed business and strategy updates to the Board. AtBoard, and at least annually, the Board conducts an in-depth review of the Company’s overall strategy. AtIn these reviews,meetings, the Board engages with seniorexecutive management and other business leaders regarding, among other topics:regarding: | | • | | the competitive landscape; |

| • | | the Company’s budget, capital allocation plan and financial and operating performance; |

| | • | the competitive landscape; | | | • | product and technology updates; and | | • | potential acquisitions, investments and partnerships. |

| • | | potential acquisitions, strategic investments and partnerships; |

| • | | information security and data privacy; |

| • | | risk management and compliance reviews; and |

The Board looks to the expertise of its committees to inform strategic oversight in their areas of responsibility.  • 2021 Proxy Statement • 2021 Proxy Statement 22

| | | 26 | |  •2023 Proxy Statement •2023 Proxy Statement |

CORPORATE GOVERNANCE Board Oversight Risk Oversight PayPal operates in overmore than 200 markets globally in a rapidly evolving environment characterized by a heightened regulatory focus on all aspects of the payments industry. Accordingly, our business is subject to the risks inherent in the payments business and the industry generally. A sound risk management and oversight program is critical to the successful operation of our business and the protection of our Company, customers, employees customers and other stakeholders. Management is responsible for assessing and managing risk and views it as a top priority. The Board is responsible for overall risk assessment and management oversight. The Boardoversight and executes its responsibility as a group and through its committees, which regularly report at least quarterly to the full Board. The Board and its Committees consult with external advisors, including outside counsel, consultants, auditors and industry experts, to help ensure that they are well informed about the risks and opportunities pertinent to the Company. In addition to their ongoing oversight responsibilities, throughout 2020,2022, the Board and its committees regularly reviewed and discussed with management the implications of geopolitical instability (including the Russia and Ukraine conflict), supply chain shortages, higher inflation and rising interest rates, macroeconomic uncertainty and the continued impact of the COVID-19 pandemic on our employees, customers and communities. pandemic. As part of these reviews, the Board considered management’s ongoing strategies and initiatives to respond to and mitigate the adverse impactseffects of geopolitical instability, macroeconomic conditions and the continued effects of the pandemic, including creating and expanding employee initiatives and other relief efforts.pandemic. ARC Committee The ARC Committee is primarily responsible for the oversight of the Company’s risk framework and reports to the full Board on the following matters on a regular basis: Financial and Audit Risk:Meets with the independent auditor, Chief Financial Officer, Chief Accounting Officer and other members of the management team quarterly and as needed, including in executive sessions, to review the following: | | • | | quality and integrity of the Company’s financial statements and reports; |

| | • | | accounting and financial reporting practices; |

| | • | | disclosure controls and procedures; |

| • | | audit of the Company’s financial statements; |

| | • | | selection, qualifications, independence and performance of the independent auditors; and |

| | • | | effect of regulatory and accounting initiatives and application of new accounting standards. |

Enterprise-Wide Risk and Compliance:Periodically reviews and approves the framework for the ERCM Program and other key risk management policiespolicies. Meets with the Chief Risk and takesCompliance Officer, quarterly and as needed, including in executive sessions, to review and discuss the following actions:following: | | • | oversees and assesses | the Company’s overall risk framework and risk appetite framework, including risks associated with cybersecurity, information security and privacy; | | • | reviews policies and practices established by management to identify, assess, measure and manage key current and emerging risks facing the Company; | | • | meets with the management team quarterlyCompany, including regulatory and on an as-needed basis to discuss key areas offinancial crimes compliance, technology (including cybersecurity, information security and privacy), operational, portfolio, capital, strategic, extended enterprise, riskthird-party and execution of risk management; and | | • | reviews with the Company’s Chief Business Affairs and Legal Officer, Chief Risk Officer and Chief Compliance Officer, as applicable, significant legal, regulatory or compliance matters that could have a material impact on our financial statements, business or compliance policies.reputational risks; |

| • | | compliance risks, the level of compliance risk, management actions on significant compliance matters and reports concerning the Company’s compliance with applicable laws and regulations; and |

| • | | periodic reports from the Chief Risk and Compliance Officer and other members of management regarding ongoing enhancements to, and overall effectiveness of, the Company’s risk management program, including actions taken by management to address risks, the progress of key risk initiatives and the implementation of risk management enhancements. |

Internal Audit:Meets with the Vice President, Risk and Internal Audit, quarterly and on an as-needed basis,as needed, including in executive sessions, to discuss the performance of the Company’s internal audit function and the independent auditor. Reviews and approves the annual risk-based audit plan and any significant changes to such plan. Legal and Regulatory:Our Chief Business Affairs Meets with the General Counsel and Legal Officer,the Chief Risk Officer and Chief Compliance Officer, work with the ARC Committeequarterly and as needed, including in executive sessions, to review significant legal, regulatory or compliance matters that could have a material impact on our financial statements, business or compliance policies. Compensation Committee The Compensation Committee is primarily responsible for the following areas and reports to the full Board on these matters on a regular basis: | | • | | oversees and reviews the risks associated with our compensation policies, plans and programs; |

| | • | | oversees regulatory compliance with respect to compensation matters; |

| | |  •2023 Proxy Statement •2023 Proxy Statement | | 27 |

CORPORATE GOVERNANCE Board Oversight | | • | | oversees and monitors the Company’s strategies related to human capitaltalent management, including the recruitment and retention of key talent, pay equity, corporate culture, diversity, inclusion, equity and belongingDIE&B and other key human capital management programs and initiatives; and | | • | oversees succession planning. |

• 2021 Proxy Statement • 2021 Proxy Statement 23

Governance Committee The Governance Committee is primarily responsible for the following areas and reports to the full Board on these matters on a regular basis: | | • | | oversees and reviews the risks associated with our overall corporate governance framework, principles, policies and practices; |

| | • | | oversees ESG matters generally, including overall ESG strategy, risks and opportunities, stakeholder engagement and reporting, and programs and initiatives in social innovation and environmental sustainability;sustainability and | | • | oversees political contributions the Company’s annual Global Impact Report; and expenditures and lobbying activity. |

| • | | oversees political activities and expenditures. |

Management’s Risk and Compliance Framework Management regularly reviews and discusses with the ARC Committee the overall effectiveness of, and ongoing enhancements to, the ERCM Program.

| | | | | | • Management’s risk and compliance framework is designed to enable the ARC Committee to effectively oversee the Company’s risk management practices and capabilities.

• The Company’s risk management committees, including the Enterprise Risk Management Committee (“ERM Committee”), oversee the implementation and execution of the ERCM Program.

• The ERM Committee is the highest-level risk management committee, is co-chaired by PayPal’s Chief Risk Officer and Chief Compliance Officer, and reviews periodic reports from management regarding assessment of the effectiveness of the ERCM Program.

• The ERCM Program’s objective is to identify, measure, manage, monitor and report key risk factors facing our Company including:

• Financial crime and regulatory compliance

• Operational, credit and capital structure

• Technology, cybersecurity and privacy

• Strategic, reputational risk and business continuity

• Key ESG considerations are integrated into our ERCM Program and emerging ESG trends are regularly reported to a subcommittee of the ERM Committee.28

| | Effectively managing privacy and cybersecurity risks is paramount and an integral component of the ERCM Program  •2023 Proxy Statement •2023 Proxy Statement

• Our Global Privacy Program is based on eight data protection principles that serve as the basis for enterprise-wide standards:

| | Management | Notice &

Transparency | Choice &

Consent | Security | |  |  |  |  | | | | | | | Data

Lifecycle

Management | Data

Quality | Stewardship | Standardization | |  |  |  |  | | | | | | | • Our Global Privacy Team, as well as dedicated teams integrated throughout our business, foster a “Data Hygiene by Default” and “Privacy by Design” culture throughout the Company.

• Our Information Security Program is designed to enable robust cybersecurity management across our global enterprise and support the Company in identifying, protecting, detecting, responding to and recovering from information security threats.

|

CORPORATE GOVERNANCE Executive Succession Planning Executive Succession Planning The Board recognizes the importance of effective executive leadership to PayPal’s success and Committee Evaluations reviews executive succession planning at least annually. As part of this process, the Board reviews and committee evaluations play a critical role in ensuringdiscusses the effectivenesscapabilities of our Board. The Boardexecutive management, as well as succession planning and its principal committees perform an annual self-evaluation to assess their performance and effectiveness and to identify opportunities to improve. The Governance Committee annually reviews the self-evaluation process to ensure it is operating effectively.

• 2021 Proxy Statement • 2021 Proxy Statement 24

Board and Committee Meetings and Attendance

Our Board typically holds at least four regularly scheduled meetings each year, in addition to special meetings scheduled as appropriate. At each regularly scheduled quarterly Board meeting, a member of each principal Board committee reports on any significant matters addressed by the committee since the last quarterly meeting, and the independent directors have the opportunity to meet in executive session without management or the other directors present. The Board expects that its members will rigorously prepare for, attend and participate in, all Board and applicable Board committee meetings.

Our Board met eight times during 2020. Each director nominee who served in 2020 attended at least 75% of all our Board meetings and meetingspotential successors for the committees on which he or she served.

All directors are encouraged to attend the Annual Meeting. Last year, all directors serving at the timeCEO and our other executive officers. The process includes consideration of our 2020 Annual Meeting of Stockholders attended that meeting.

Stockholder Engagement

63%

Reached out to of common stock

| | 31%

Engaged with of common stock

| We recognize the value of a robust stockholder outreach program. We engage in regular, constructive dialogue with our stockholders on matters relevant to our business, including corporate governance, ESG issues and executive compensation, so we can better understand their views and interests and share our perspectives on these important subjects. |

organizational and operational needs, competitive challenges, leadership/management potential and development and emergency situations. In addition2022, we were proud to the outreach conducted in the weeks leading upwelcome new leaders, including Archie Deskus, Blake Jorgensen and John Kim, to our 2020 Annual Meeting, following our 2020 Annual Meeting, we again reached outsenior leadership team. In light of Mr. Schulman’s announced intention to our investorsretire from PayPal as President and CEO at year-end, the Board has formed a CEO search committee and retained a search firm to solicit feedback. In 2020, we contacted investors representing approximately 63% of our common stock, and holders of approximately 31% of our common stock responded and engaged with us.help identify Mr. Schulman’s successor. The table below provides an overview of the key topics, areas of stockholder focus and management’s responses covered during our 2020 stockholder outreach meetings.

Key Topic | Area of Stockholder Focus | How We Responded | COVID-19 Pandemic | • PayPal’s COVID-19 response and relief efforts targeted at internal and external stakeholders

• PayPal’s involvement in the SBA PPP and the stimulus check distribution program

|  Management indicated that throughout the pandemic, PayPal has prioritized the safety, security and well-being of its workforce. The Company mobilized nearly 100% of its global workforce to work under flexible work arrangements, and strengthened programs focused on employee wellness, including its crisis leave program and employee assistance program. PayPal also worked actively to help its customers and communities to navigate the challenges brought by the pandemic. Management indicated that throughout the pandemic, PayPal has prioritized the safety, security and well-being of its workforce. The Company mobilized nearly 100% of its global workforce to work under flexible work arrangements, and strengthened programs focused on employee wellness, including its crisis leave program and employee assistance program. PayPal also worked actively to help its customers and communities to navigate the challenges brought by the pandemic.

PayPal has worked with the SBA to provide small businesses with access to more than $2 billion in loans through the PPP in 2020 with an average loan size of $28,000. PayPal has worked with the SBA to provide small businesses with access to more than $2 billion in loans through the PPP in 2020 with an average loan size of $28,000.